By now, we’ve all heard the news that low inventory has been driving an unprecedented seller’s market in real estate across the country. In fact, the number of homes for sale has reached a record low, driving competition and prices higher than ever before. While this presents an amazing opportunity for sellers, many buyers wonder whether they should act now or just wait it out. Read on for our guide to understanding the historic seller’s market and what it means for your real estate goals.

What’s Creating the Seller’s Market?

Home buying took a pause when the pandemic began in the United States about a year ago. According to HouseCanary, a real estate technology and analytics company, home sales dropped by about 40 percent nationally. That trend lasted for about six to eight weeks in Minnesota. However, when demand and sales bounced back in May, the inventory did not.

The median home sales price has grown 16 percent from last year, according to national statistics from the National Association of Realtors. Locally, inventory is down 46.3 percent compared to 2020, while the new median sales price is at a record $314,000, an increase of 11.5 percent.

Historically Low Mortgage Rates

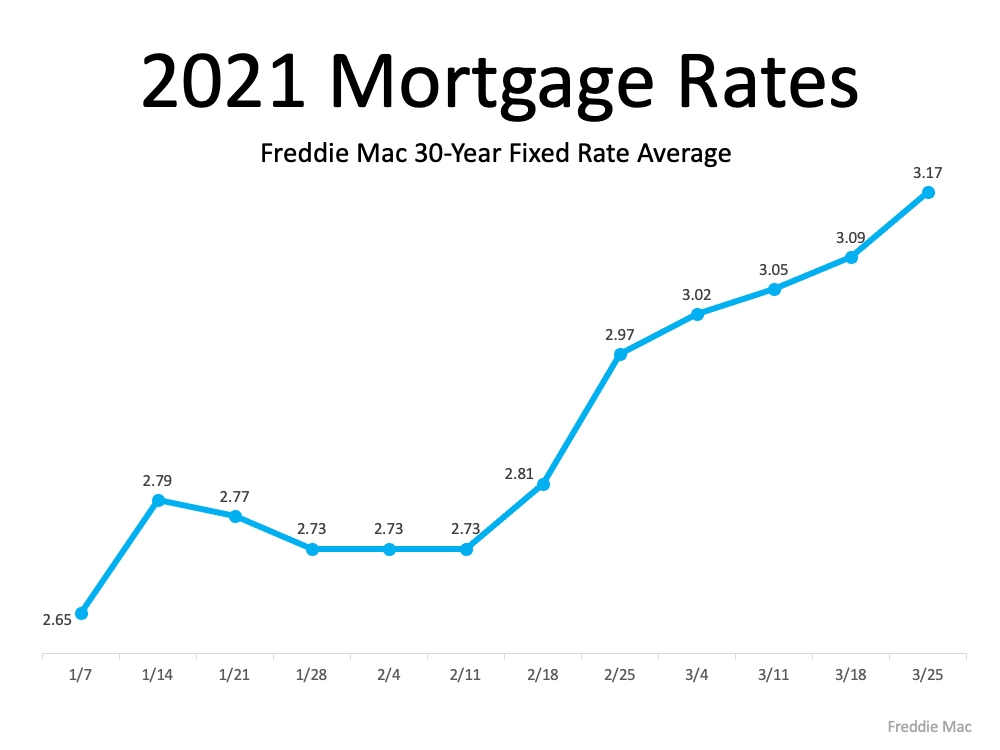

Historically low interest rates have played a major role in increased buyer demand. Many people realized they could actually save money by buying a home instead of renting. Chad, a young buyer who worked with Jarrod Peterson last year to purchase his first home, was able to save $315 on his monthly payment when he decided to invest in himself instead of paying rent.

However, the low rates also influenced millions of homeowners to refinance their property in 2020. As a result, they’re not likely to list their home for sale anytime soon, thus keeping available inventory low.

Influence of an Eager Millennial Market

Millennials make up the largest consumer pool in the marketplace and they are ready to purchase. Again, while historically low interest rates have played a crucial role in this trend, they’ve started to rise recently.

In the second half of 2021, we will continue to see rates on the rise. Jarrod Peterson Real Estate Group works with some of the leading lenders in the area. If you plan on buying a home, contact us today and we’ll help find the ideal financing solution for you.

Homebuilders Cannot Keep Up with Demand

Building more houses seems like a simple solution for low inventory, right? Unfortunately, the process is a bit more complicated. Homebuilders around the nation bought more land in 2020 than in the past few years combined, but it takes time to get that land approved, developed, and ready for market.

Be a Success Story with Jarrod Peterson

In the first quarter of 2021, the Jarrod Peterson Real Estate team closed on 29 transactions. Of those, 24 (or 83 percent) sold above asking price and received multiple offers. One particular home in Bloomington received 21 offers and sold for an astonishing $52,000 higher than the original listing.

We can expect this marketplace to remain for the next couple years. Understanding the historic seller’s market tells us that multiple bids, fast closings, and “above asking price” sales represent the new norm in 2021. If you are thinking about making a change and want to know the value of your property, trust the award-winning Jarrod Peterson Real Estate team.

Contact us to learn more and get started today.